NEWSLETTER

March Client Update Newsletter

Tax season is now underway! In this month's newsletter, we share the secret to getting a quick tax refund.

Also read about tax saving tips for parents and grandparents, why you should consider reading the fine print, and several financial tips about how to navigate rising interest rates.

Please enjoy the information, and pass along articles of interest to all your family and friends. And as always, please call if you have questions or need help.

The Secret to a Quick Tax Refund

Here's how to get your overpayment as soon as possible

Here's how to avoid getting your tax refund delayed and steer clear from late-filing and payment penalties resulting from a massive IRS backlog of unprocessed tax returns.

Read the Fine Print

According to a recent Deloitte survey, 91 percent of people agree to terms and conditions without reading the legal agreement. Here are four reasons why reading entire legal agreements make sense.

Tax Saving Tips for Parents AND Grandparents

Leveraging the kiddie tax rules

With careful tax planning, you can use the kiddie tax rules to reduce your tax obligation. Here's what you need to know.

Review Financial Decisions When Interest Rates Change

Here's how you could be affected by rising interest rates.

As always, should you have any questions or concerns regarding your tax situation please feel free to call.

Newsletter

February Client Update Newsletter

With tax season now officially underway, you’ll start seeing more tax documents show up in your inbox or mailbox. And this year, there are some unusual ones arriving, so outlined here is what to expect. Also included is an article discussing common areas of tax surprises plus some ideas to help you protect yourself while online and ways to minimize your digital footprint.

All this and some great ideas for you if you have a home-based hobby or business.

Please enjoy the information, and pass along articles of interest to all your family and friends. And as always, please call if you have questions or need help.

Easy-to-Overlook Tax Documents

This year is a little more challenging

With tax season now officially underway, here are several tax documents that may be easy to miss in your mailbox or inbox.

I Owe Tax on That?

5 Surprising Taxable Items

Wages and self-employment earnings are taxable, but what about the random cash or financial benefits you receive through other means? Here are five taxable items that might surprise you.

Great Tips for Your Home-Based Business

Home-based businesses can be financially rewarding and provide flexibility with your day-to-day schedule. Here are some tips to keep your business running at full steam.

Protecting Your Digital Footprint

In today's digital age, it is impossible to avoid the internet. Here are some tips to help you manage your digital footprint.

As always, should you have any questions or concerns regarding your tax situation please feel free to call.

Newsletter

January Client Update Newsletter

The new year is upon us and so is another tax filing season.

With all the late breaking tax law changes, advance payments of the child tax credit, and several stimulus payments, this year's tax return may be a bit chaotic. But your situation does not have to be. Included in this month's newsletter are some tips to help your tax journey be a smooth one.

Also included is a great reminder for all of us to be prepared in case of fire. With the busy nature of our lives, this is an area that can be easily overlooked. There are also timely updates to retirement plan contribution limits for 2022 and a great list of ideas to help your small business prepare for the upcoming tax season.

Please enjoy the information, and pass along articles of interest to all your family and friends. And as always, please call if you have questions or need help.

Make Order Out of Chaos

Prepare for this year's tax return filing season

Multiple, late-breaking tax legislation now makes filing a tax return more complicated than ever. Here are some ideas to make your situation manageable.

If You Wait, It's Too Late!

Fire survival occurs before the first signs of smoke

Survival and recovery from a fire occurs long before you see the first sign of smoke. Here are some great reminders.

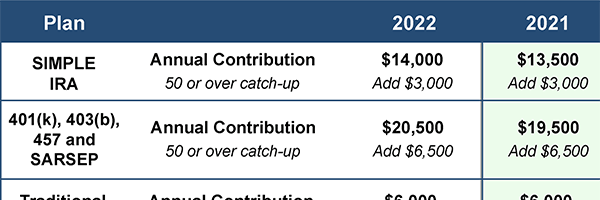

Plan Your Retirement Savings Goals for 2022

With the new year, now is the time to take full advantage of tax benefits for your retirement. Doing this EVERY year is critical to maximizing savings and minimizing taxes.

Small Business Tax Return To-Do-List

Eight ideas to make filing your tax return easier

To help make this year's tax filing process easier, consider the following ideas.

As always, should you have any questions or concerns regarding your tax situation please feel free to call.